Investment Opportunities

-

Launching Soon Come back soon to invest in this opportunity.

-

Launching Soon Come back soon to invest in this opportunity.

-

Launching Soon Come back soon to invest in this opportunity.

-

Launching Soon Come back soon to invest in this opportunity.

-

Launching Soon Come back soon to invest in this opportunity.

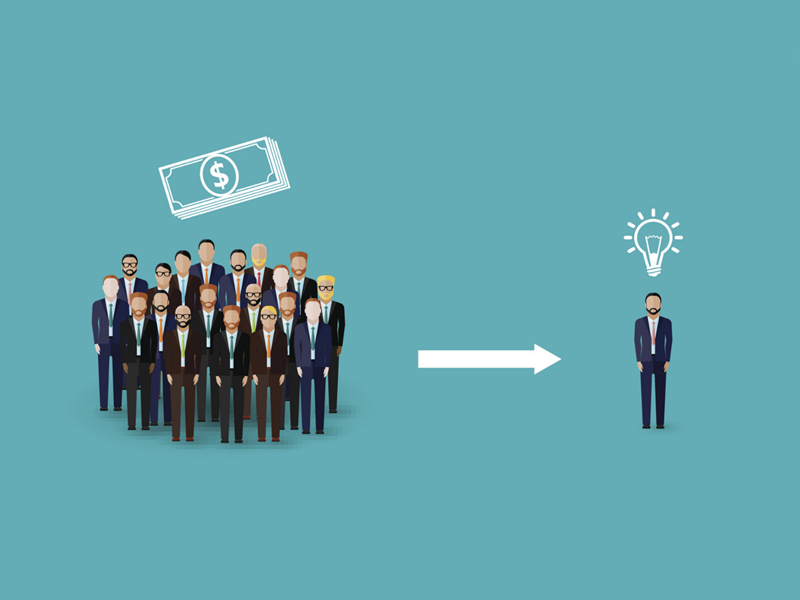

What is Equity Crowdfunding?

It means a lot of people provide money to a business idea in return for a stake in that company.

When the company grows, so does your investment.

It's easy to invest

Step 2

Make your payment

Step 3

Wait for your shares to be issued

Why choose crowdfunding.com.au

Diverse Opportunities

Review a variety of investment opportunities from startups to established companies in a range of industries.

Track your investments

You can build and keep track of your investment portfolio.

Flexibility

Invest as little as $100 or invest up to $10,000 per opportunity, you choose your amount of shares.

Secure payments

Safely invest anywhere anytime knowing your personal details are protected.

Due diligence

We vet every idea and you should do your research too by reading each opportunity’s business plan and growth strategy.

Anywhere, anytime

You just need to be over the age of 18 and be an Australian resident.

Four-click investing

The power of the crowd

Equity crowdfunding is a modern way to start investing or to grow your portfolio. As with any form of investing, you should understand that there is always a risk of failure.

Some of the most impressive innovations have come out of crowdfunding. Oculus Rift, one of the first VR headsets, received nearly $2.5 million in 30 days of crowdfunding. That very same company went on to be acquired by Facebook for $2 billion.

To put into perspective how significant a small investment can be, if you’d have had the opportunity to invest $100 into Uber in 2010, your investment would now be worth over $1 million.*

* Reported by Equities.com in their article "$100 Invested in Uber in 2010 Would Be Worth Over $1 Million By 2015".

How do I exit my investment or receive a return?

Trade sale

Another business buys out the company, or part of it. The sale price is then divided accordingly between the shareholders.

Public offering

The company is listed on the stock exchange and offers shares to the public. Existing shareholders may sell their shares to the public at this point.

Dividends

If a company makes a profit, it may choose to pay a portion of this as a dividend to shareholders.